Revisiting the Benefits of International Diversification

Ever since the Great Financial Crisis of 2007-2008, when the correlation of all risky assets rose toward 1, investors have been hearing that because of globalization, the world has become flat and the benefits of diversification are gone.

The explanation is generally that the world market has become more integrated and financial markets more globalized. This has led some investors to draw the wrong conclusions about the benefits of international diversification.

With that in mind, we’ll take a deep dive into the issue of how much an allocation to international stocks you should have.

Recent Research From Vanguard

We’ll begin with a look at the February 2019 paper by Vanguard’s research team, “Global Equity Investing: The Benefits of Diversification and Sizing Your Allocation.” The authors, Brian Scott, Kimberly Stockton and Scott Donaldson, began my noting that, as of September 2018, U.S. stocks accounted for 55.1% of the global equity markets—almost twice the low of 29% it reached in the 1980s. Thus, regardless of residence, investors who focus solely, or mostly, on domestic stocks exclude a large portion of the global equity market.

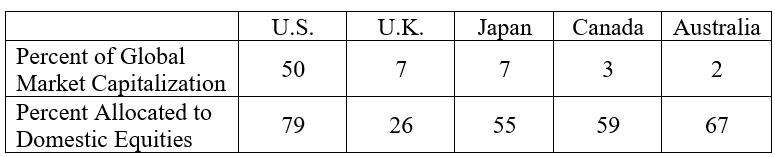

Scott, Stockton and Donaldson note: “The rationale for diversification is clear—domestic equities tend to be more exposed to the narrower economic and market forces of their home market while stocks outside an investor’s home market tend to offer exposure to a wider array of economic and market forces.” Despite the benefits, in a 2017 study, Vanguard found that in each case they examined, investors exhibited a strong home country bias.

When they examined returns over the period beginning in 1970, Scott, Stockton and Donaldson found that “While the United States had the lowest volatility of any individual country examined, its volatility was slightly higher than that of the global market index.”

When they performed a forward-looking 10-year minimum variance analysis, they found that, in each market, the marginal benefit to international diversification declines as allocations to international equity increase, with portfolio volatility beginning to rise with allocations of greater than 40-50% to international equities.

The authors also examined the issue of currency risk. They first note: “Long term, currency has no intrinsic return—there is no yield, no coupon, no earnings growth. Therefore, long term, currency exposure affects only return volatility.”

In terms of volatility, they found that, in all regions, currency risk had very little impact on long-term performance, whether or not it was hedged. Sometimes hedging reduced volatility; in others, it led to an increase.

Scott, Stockton and Donaldson concluded that a good starting point for investors is the global market-capitalization weight. This raises the question of why investors all over the globe exhibit a strong home country bias. The field of behavioral finance provides some likely answers. The first is the tendency to confuse the familiar with the safe.

Familiarity Breeds Investment

With the breakup of AT&T (“Ma Bell”), shareholders were given shares in each of what were called the Baby Bells. A study done a short time later found that the residents of each region held a disproportionate number of shares of their local regional Bell. Each group of regional investors was confident their regional Baby Bell would outperform the others. How else can you explain each investor having most of their eggs in one baby basket?

Investors tend to view domestic stocks as safer and better investments than their international counterparts. For example, a study by Ken French and James Poterba, “Investor Diversification and International Equity Markets,” found that the expected realreturn to U.S. equities was 5.5% in the eyes of U.S. investors, but only 3.1% and 4.4% in the eyes of Japanese and British investors, respectively.

Similarly, the expected return on Japanese equities was 6.6% in the eyes of Japanese investors, but only 3.2% and 3.8% in the eyes of U.S. and British investors, respectively. Familiarity breeds overconfidence (or an illusion of safety), and lack of familiarity breeds a perception of high risk.

Many investors avoid adding international investments to their portfolios because they believe international investing is too risky. Is this perception accurate? Debra Glassman and Leigh Riddick, authors of the study “What Causes Home Asset Bias and How Should It Be Measured?” found that portfolio allocations to foreign and domestic securities by U.S. investors are consistent with the belief by investors that the standard deviations of foreign securities are higher by a factor of 1.5 to 3.5 than their historical value.

The evidence demonstrates investors tend to make mistakes due to biases they are likely unaware of. You no longer have that excuse. And there’s another bias that U.S. investors have to deal with—recency.

Recency

“Recency” is the tendency to overweight recent events/trends and ignore long-term evidence. This leads investors to buy after periods of strong performance—when valuations are higher and expected returns are lower—and sell after periods of poor performance—when prices are lower and expected returns are higher. This results in the opposite of what a disciplined investor should be doing: rebalancing to maintain their portfolio’s asset allocation.

Recency bias becomes an even greater problem in combination with familiarity bias. The table below examines the returns over the past 10 calendar years from 2009 through 2018.

Looking at these results, it’s easy to understand why U.S. investors might be questioning the benefits of international diversification. However, to address questions about where the benefits can be found, we don’t have to look too far back in time.

The problem is that investors’ memories can be short, often much shorter than is required to be a successful investor. The period we’ll examine is the five years from 2003 through 2007, the period just before the Great Financial Crisis.

As you can see, results from 2003 through 2007 were the reverse of what they were from 2009 through 2018, with international stocks far outperforming U.S. stocks. As Spanish philosopher George Santayana famously warned, “Those who cannot remember the past are condemned to repeat it.” In general, dramatic outperformance (underperformance) is accompanied by rising (falling) valuations, which generally lead to reversion in returns—higher valuations predict lower future returns and vice versa. Given the last 10 years’ returns, it should not be a surprise that U.S. valuations are now much higher than international and emerging market valuations (the best predictor we have of future returns). The table below shows the current forward-looking P/E ratios for three of Vanguard’s ETFs. Data is from Morningstar as of January 31, 2019.

Vanguard S&P 500 ETF (VOO): 16.1

Vanguard FTSE Developed Markets ETF (VEA): 12.6

Vanguard FTSE Emerging Markets ETF (VWO): 11.5

As you can see, valuations are considerably lower for international stocks. While that suggests they have higher expected returns, it’s important to understand the lower valuations don’t mean they’re better investments. The lower valuations reflect the greater risk investors perceive.

We’ll now address the issue of international diversification failing when it was needed most, during the financial crisis.

Take The Long View

While international diversification doesn’t necessarily work in the short term, it does eventually. This point was the focus of a paper by Clifford Asness, Roni Israelov and John Liew, “International Diversification Works (Eventually).” They explained that those who focus on the fact that globally diversified portfolios don’t protect investors from short systematic crashes miss the greater point that investors whose planning horizon is long term (and it should be, or you shouldn’t be invested in stocks to begin with) should care more about long-drawn-out bear markets, which can be significantly more damaging to their wealth.

In their study, which covered the period 1950-2008 and 22 developed-market countries, the authors examined the benefit of diversification over long-term holding periods. They found that, over the long run, markets don’t exhibit the same tendency to suffer or crash together. Thus, investors shouldn’t allow short-term failures to blind them to long-term benefits.

To demonstrate this point, they decomposed returns into two pieces: (1) a component due to multiple expansion (or contraction); and (2) a component due to economic performance. They found that while short-term stock returns tend to be dominated by: (1), long-term stock returns tend to be dominated by (2). They explained that these results “are consistent with the idea that a sharp decrease in investors’ risk appetite (i.e., a panic) can explain markets crashing at the same time. However, these risk aversion shocks seem to be a short-lived phenomenon. Over the long-run, economic performance drives returns.”

They further showed that “Countries exhibit significant idiosyncratic variation in long-run economic performance. Thus, country specific (not global) long-run economic performance is the most important determinant of long-run returns.”

For example, in terms of worst-case performances, they found that, at a one-month holding period, there is very little difference in performance between home-country portfolios and global portfolios. However, as the horizon lengthens, the gap widens—the worst cases for the global portfolios are significantly better (the losses are much smaller) than the worst cases for the local portfolios. And the longer the horizon, the wider the gap favoring the global portfolios.

Demonstrating the point that long-term returns are more about a country’s economic performance and that long-term economic performance is quite variable across countries, they found that “Country specific economic performance dominates long-term performance, going from explaining about 1% of quarterly returns to 39% of 15-year returns and rising quite linearly in time.”

The next issue we’ll discuss relates to the question of whether owning U.S. multinationals is the way to gain international diversification.

Effective International Diversification

Cormac Mullen and Jenny Berrill contribute to the literature on the benefits of international diversification with their study “Mononationals: The Diversification Benefits of Investing in Companies with No Foreign Sales,” which was published in the Second Quarter 2017 issue of Financial Analysts Journal.

Mullen and Berrill showed that one way to recover international diversification benefits is to decrease the internationalization in investors’ portfolios by lowering exposure to the stocks of foreign multinationals and focusing on what they call “mononationals.”

They concluded: “Despite the decrease in international diversification benefits documented in recent papers—and a research focus in recent years on the benefits of stocks from emerging and frontier markets—we found that there is still international diversification potential in developed-market equities. We suggest that a portfolio of international stocks classified solely as domestic offers the potential for more international diversification benefits than a portfolio of more-internationalized stocks.”

Their conclusion has the benefit of being intuitive. That said, there’s really nothing new here. Multinationals are more likely to be large companies, and mononationals are more likely to be smaller companies. It’s long been known that the benefits of international diversification are greatest when investing in smaller companies.

For example, Rex Sinquefield’s study “Where Are the Gains from International Diversification?”, which appeared in the January-February 1996 issue of the Financial Analysts Journal, showed that international small stocks diversified U.S. portfolios more than did the large stocks of the EAFE Index.

While foreign large companies have exposure to their domestic economies, their earnings are more likely to be impacted by global conditions than those of smaller companies, which tend to be more dependent on the conditions of their local economies. Thus, the returns of smaller companies are driven more by local idiosyncratic factors. This makes them more effective diversifiers than international large stocks.

As an example, the performance of two giant global pharmaceutical companies like Merck and Roche is likely to be more highly correlated—because their products are sold all around the globe—than the performance of two small-cap domestic restaurant chains whose products are sold only in their home countries.

Small Stocks Offer Greater Diversification

When designing a portfolio, all else equal, we would prefer to add asset classes that have lower correlations. With that in mind, to see which international asset classes provide the greatest diversification benefits, we’ll look at the correlation data for both large and small stocks. The table below shows the annual correlations for the last 20 calendar years, January 1999-December 2018.

As you can see, the benefits of international diversification are greater when investing in small stocks versus large stocks. For example, the correlation of the S&P 500 Index to the EAFE Index was 0.86 versus 0.76 for the EAFE Small Cap Index. We see the same result when looking at the correlation of the S&P 500 Index to the MSCI Emerging Markets Index. For large stocks, it was 0.76 versus 0.70 for small stocks.

Because of their lower correlation and the higher expected returns of international small stocks (and even higher for small value stocks), you should consider including an allocation to them when constructing your portfolio. For example, using Dimensional indices, from 1990 through 2018, while the EAFE Index returned 4.4%, the Dimensional EAFE Small Cap Index returned 6.1% and the Dimensional EAFE Small Value Index returned 7.4%. Too many investors only include an allocation to the EAFE and Emerging Markets Indices.

The bottom line is that if you want to improve the diversification benefits of your international stocks, increase your exposure to small and/or small value stocks, both in developed and emerging markets. That will not only provide the benefits of reduced correlations, but greater exposure to the size and value premiums, which have been just as persistent and pervasive internationally as they have been in the U.S.

You can see the evidence on their returns in “Your Complete Guide to Factor-Based Investing.” Their higher expected returns also allow you to hold less equity risk overall, which historically has reduced the risk of drawdowns. For those interested in how using factor premiums can reduce tail risk, I recommend “Reducing the Risk of Black Swans,” 2018 edition.

We have one more point to cover. When thinking about the benefits of diversification, it’s important to understand that correlations are not the only thing that matters. As long as there’s a dispersion of returns (which there has been every year since 2008), there are diversification benefits.

Dispersion Of Returns

In 2009, we saw wide dispersion of returns. For example, while the S&P 500 was up almost 27%, the MSCI Emerging Markets Index rose 79%. And emerging market small-cap and value stocks produced even higher returns.

In addition, international large value and small value stocks as well as international real estate investment trusts (REITs) outperformed their domestic counterparts by wide margins. Note that while the correlations were positive, as all equity asset classes produced above-average returns, the world didn’t look flat in 2009.

In 2010, even though the S&P 500 returned about 15%, emerging market stocks outperformed by about 4 percentage points. On the other hand, U.S. large, large value, small, small value and REIT funds outperformed their foreign counterparts by significant margins.

In 2011, while the S&P 500 returned just greater than 2%, international stocks generally provided negative returns. For example, the MSCI Emerging Markets Index lost more than 18%.

In 2012, the relative performance of U.S. and international funds reversed: International funds outperformed their U.S. counterparts in all asset classes, although the return differences were relatively small.

In 2013, U.S. stocks outperformed international equity by wide a margin. For example, the S&P 500 Index, which returned 32.4%, outperformed the MSCI EAFE Index by about 10 percentage points and the MSCI Emerging Markets Index by approximately 35 percentage points. The world didn’t look very flat in 2013, either.

In 2014, domestic stocks generally far outperformed international stocks, as U.S. stocks rose and developed non-U.S. markets generally fell. Again, the world didn’t look flat.

In 2015, returns were all over the place. For instance, U.S. large stocks and developed non-U.S. stocks produced similar returns, both close to zero. On the other hand, the MSCI EAFE Small Cap Index rose about 10%, while the MSCI EAFE Small Value Index rose roughly 5%. Their U.S. counterparts lost 4% and 5%, respectively. At the same time, the MSCI Emerging Markets Index lost almost 15%. Once again, the world didn’t look flat.

In 2016, the world wasn’t totally flat. While the S&P 500 returned 12.0%, the MSCI Emerging Markets Index returned an almost identical 11.6%. However, the MSCI EAFE Index returned just 1.5%. Here’s another example: While the MSCI US Small Value Index returned 27.6%, the MSCI EAFE Small Value Index returned just 6.4%.

In 2017, we saw again that the world isn’t flat. For example, while the S&P 500 Index returned 21.8%, the MSCI EAFE Index returned 25.6% and the MSCI Emerging Markets Index returned 37.8%. As another example, while MSCI US Small Value Index returned 9.2%, the MSCI EAFE Small Value Index returned 30.9%—almost a complete reversal of the prior year’s returns.

2018 was no different. While the S&P 500 Index lost 4.4%, the MSCI EAFE Index lost 13.4% and the MSCI Emerging Markets Index lost 14.2%.

These examples demonstrate that correlations don’t tell the true story about the benefits of international diversification. To see the benefits, you have to also look at the dispersion in returns. The bottom line is that, despite markets becoming more integrated and correlations rising somewhat, there is still wide dispersion of returns—showing the benefits of diversification even in a flatter world.

Summary

The evidence presented here demonstrates that, even though the benefits of a global equity allocation may have been reduced by market integration, they have not disappeared.

The conclusion that Asness, Israelov and Liew drew in their study “International Diversification Works (Eventually),” and the one you should draw, is that while global diversification can disappoint over the short term, over the long term, which is far more relevant, “It is the free (and hearty!) lunch that theory and common sense says it should be.”

If you need a specific example of the wisdom of this advice, look to Japan. Clearly, Japanese investors have benefited from global diversification. The poor returns Japan experienced since 1990 (from 1990 through 2018, the MSCI Japan Index returned 0.18%) weren’t a result of systemic global risks. They happened because of Japan’s idiosyncratic problems.

Before you make the mistake of confusing the familiar with the safe, you cannot know which country or countries will experience a prolonged period of underperformance. That uncertainty is what international diversification protects you against.

Broad global diversification is still the prudent strategy. As Vanguard recommended, a good starting point for deciding how much to allocate to international markets is the global market capitalization. That said, there are some valid reasons for a U.S. investor to have a small home country bias.

When investing internationally, implementation costs can be higher in terms of expense ratios of funds, trading costs and taxes. Thus, while the global market capitalization is a good starting point for allocating capital, the higher costs of investing internationally might lead to a slightly higher allocation to U.S. stocks.

On the other hand, if you are still employed, your labor capital is likely to be more exposed to the idiosyncratic risks of the U.S. economy. Thus, if your labor capital is highly correlated to the U.S. economy, you might consider an even higher allocation to international stocks.

Hopefully, the evidence presented here demonstrates that, even though the benefits of a global equity allocation may have been reduced by market integration, they have not disappeared. Broad global diversification is still the prudent strategy.

This commentary originally appeared April 3 on ETF.com

By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them.

The opinions expressed by featured authors are their own and may not accurately reflect those of the BAM ALLIANCE®. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice.