Levers and Landmines of Annuity Products

Annuities are a popular way to supplement retirement income, provide tax-deferred growth and assist in legacy planning. But what are your options when an annuity no longer serves you?

Annuities can be a key component in a robust retirement plan. These insurance contracts provide a low-risk opportunity to increase your guaranteed income stream, provide tax-deferred growth and assist in legacy planning. Although the basics of annuities are the same, each insurance company, contract and situation is different. Most commonly, consumers can purchase deferred variable or fixed-indexed annuities before retirement, either through a series of payments or in one lump sum, in exchange for regular disbursements in retirement. Each annuity contract has both pros and cons. Depending on the type of agreement, you may encounter the following:

| Levers | Landmines |

|---|---|

| Cash Flow Security: Annuities can be a good way to diversify your cash flow. After annuitization – or when distributions begin – they offer a fixed income stream that is not affected by market volatility, which can help to balance the risks in your portfolio. Instead, market risk shifts to the insurance company. | Complexity: It may be challenging to understand the different types of annuities and the associated fees and risks. |

| Tax-Deferred Growth: Annuities offer tax-deferred growth, meaning you do not pay taxes on the earnings until you withdraw the money. This can be an advantage for those in a high tax bracket when contributing but expect to be in a lower tax bracket during distribution./td> | Lack of Liquidity: Annuities are designed to provide a steady income stream and are not typically meant to be used as a source of liquidity. If you need to access your money before the annuity’s surrender period is up or age 59½, you may face surrender charges and tax penalties. |

| Guaranteed Income: Upon annuitization, an annuity offers a guaranteed income stream that will last for a period of time – up to the rest of your life – regardless of how long you live | Inflation Risk: Annuities typically provide a fixed income stream that is not adjusted for inflation. This means that over time, inflation may erode the purchasing power of your income. |

| Legacy Planning: If you choose a joint and survivor annuity, you can ensure that your spouse or other beneficiaries will continue to receive income after your death. | High Fees: Annuities can come with high fees, including surrender charges, mortality, expense, administrative and rider fees. These costs will eat into your returns and reduce the amount of income you receive. |

| Tax Planning: Deferred annuities can produce taxable income on demand (after age 59½), which can help with generating income in low tax years. | Tax Penalties: Deferred annuities withdrawn before age 59½ are subject to a 10% tax penalty. There are a few exceptions to this rule. |

Annuity best practices

As a rule of thumb, when buying a new policy or reviewing an existing annuity, consider these important points:

What are your current and future situation and cash flow needs?

What are the restrictions in the policy?

How much does the policy cost and how is the cost determined?

What are the surrender charges, if any, and how do they compare to the annual costs?

Do you need or want the insured income?

For existing policies, are there surrender charges, taxable gains or tax penalties on withdrawals?

What are your choices when an annuity no longer serves your needs?

Due to an unexpected financial situation, sometimes individuals find their annuity is no longer necessary or not fulfilling the role imagined. Unfortunately, when an annuity is sold to you on a commission basis, you will be charged if you close out your contract during the surrender period, which may run between three to 14 years. While these fees can rarely be avoided during this time, there are ways to circumvent or continue to defer taxes when you leave a high-cost annuity.

Consider a 1035 exchange.

If an individual no longer needs an annuity as is, it is possible to surrender the annuity and pay tax on any gains. If the gains would be too expensive or you’d experience a loss, you can transfer the annuity to another annuity contract without tax consequences. This is referred to as a 1035 exchange.

A fee-only financial planner may recommend transferring outdated annuities from high-cost products to low-cost, surrender-free annuities that meet clients’ current needs and continue to allow for tax-deferred growth.

As a bonus, an individual may use a 1035 exchange to transfer the cash value from an unneeded life insurance policy. Often the cost basis of life insurance is higher than the policy’s cash value due to the internal costs of insurance. If an individual surrenders their insurance policy or annuity with a loss for cash, the loss is not recognized when taxed. Within an annuity the growth or loss is tax deferred, so you can hold an underwater annuity until the loss is recovered, tax free

Receive tax benefits by combining policies

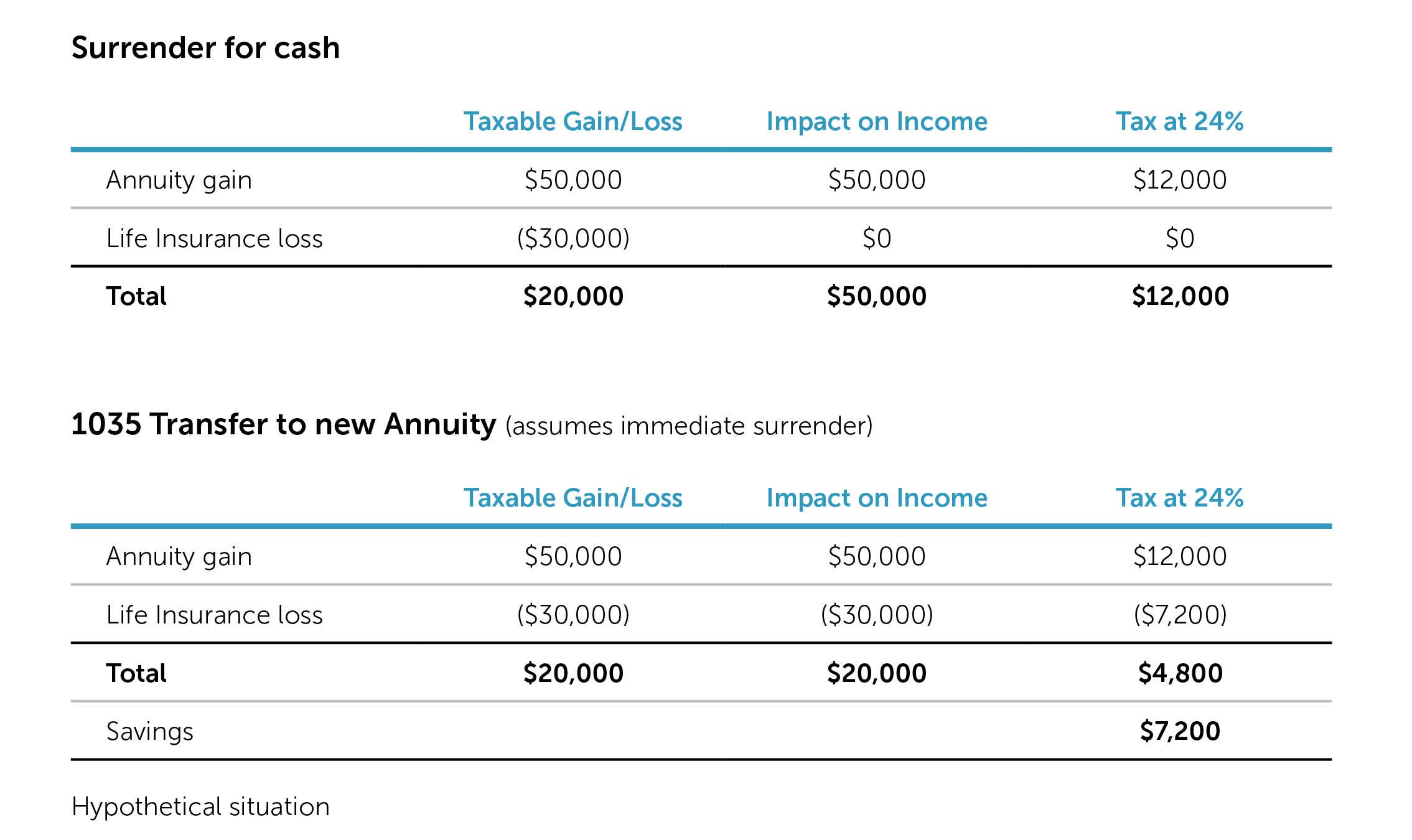

By transferring multiple old insurance or annuity policies into a single annuity, the gains and losses will offset each other to reduce the overall tax burden. The contract owner must be the same on all old and new policies. For example, the same owner can transfer an annuity with a gain and a life insurance policy with a loss into a new, low-cost, no-surrender annuity policy to offset the gain and loss. Here’s a hypothetical situation as an example:

While annuities can provide benefits like consistent income stream or offer tax-deferred growth, they also come with potential drawbacks, such as high fees, lack of liquidity, inflation risk and complexity. A 1035 exchange may be a useful tool to move funds from one annuity or life insurance policy to another annuity without triggering taxes or penalties

Weigh your options

Before deciding to buy an annuity or use a 1035 transfer, it is important to carefully consider your wealth goals and consult with your wealth advisor or tax advisor to determine the best course of action.