Allocating Your Most Valuable Asset — You

What is your most valuable asset? Your home? Not likely, even back in 2006. Your 401(k)? Doubtful, even when it was 2007. No, if you’re not yet glimpsing your retirement years, it’s likely that your biggest asset is you—and not just metaphorically.

Let’s say you’re only 30, with a degree or two and some experience under your belt. You’re making $70,000 per year. If you only get 3% cost-of-living-adjustment raises, you will crest a million in aggregate earnings in just the next 13 years.

Over the course of the next 40 years, over which you’ll almost surely continue working, you’ll earn more than $5.2 million.

Or maybe you’ve just celebrated your 40th birthday—the new 30—and you’re hitting your stride professionally, making $150,000 per annum. With only 3% raises, you’ll make more than $2.1 million in just the next dozen years.

(How’s that 401(k) looking again?)

You are your biggest asset. It’s called labor capital, and it’s an asset all too often underestimated by financial advisors and their clients.

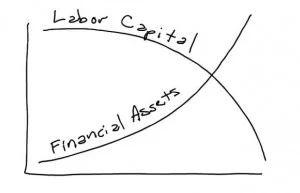

While your financial assets start small and hopefully grow over time, compounding through disciplined saving and wise investing, your labor capital brims with potential before descending later in your career.

First, we’d invest purposefully in our labor capital. Yes, this means pursuing education, but it also means cultivating our earning potential through mentoring and coaching.

It also means pursuing a job that we enjoy so we don’t feel boxed in if it’s necessary or desired to extend the longevity of our career—and our labor capital.

Second, we’d adjust the rest of our financial plan—especially our investment plan—to accommodate for our labor capital. Moshe Milevsky asks the important but rarely asked question, “Are you a stock or a bond?” in his book of the same name.

If your work offers a high reward but also high risk—let’s say you’re self-employed or you work in a cyclical boom/bust business—you’re a stock. If you enjoy the stability of your position as a tenured professor, but gripe with your colleagues about your unremarkable pay raises, you’re a bond. ”An investor’s ability to take risk is impacted by the stability of their earned income,” says Larry Swedroe in The Only Guide You’ll Ever Need for the Right Financial Plan, co-authored with Kevin Grogan and Tiya Lim.

If your labor capital acts like a stock, even if you have the intestinal fortitude to endure risk, you should likely be skewing your financial assets more conservatively. Whereas, if your income is more representative of the tortoise than the hare, you may consider infusing your portfolio with a little Usain Bolt. “[E]ffective diversification of the client’s entire household balance sheet may entail using financial capital to counterbalance against the risks of human capital,” says planning guru, Michael Kitces.

Lastly, we’d ensure that our moneymaker is adequately insured. If you work for a well-established company, it likely pays for a base level of disability income (DI). But for most, this isn’t enough, for at least two reasons:

If your company pays the premiums on your group DI policy, the benefits to you will be taxable. Most group policies cover 60% of your salary compensation (although typically not your bonus or incentive comp). If you didn’t have to worry about paying taxes, that wouldn’t be so bad, but after taxes, you’d be lucky to walk away with 40% of your gross pay—while enduring higher medical expenses on the home front.

Additionally, most group DI policies only cover your “own occupation” for two years, at which time you must be medically incapable of performing the material duties of any occupation. (Intending no offense to the gracious folks at the entrance of a Wal-Mart, this means that if you can’t pin a smiley face sticker on the front of someone’s shirt, you ain’t gettin’ your disability checks.)

To make up for either or both of these shortfalls, it makes sense for many—if not most—of us to explore the acquisition of a supplemental long-term disability income insurance policy to stack on top of your insufficient group policy. And if you’re self-employed or otherwise uncovered by a group policy, you’re entirely exposed to the risk of losing your most valuable asset. Private policies aren’t cheap and have too many moving pieces, so you’ll want to educate yourself further. But ignore this very real risk at your own peril.

BOTTOM LINE: Discussions of labor capital can be a great encouragement to those just starting their occupational journey—or those who’ve fallen behind on the accumulation of financial assets—but integrating our labor capital into our financial plan only helps if we allocate our income well. This means spending money on the most important things in life, saving money for a time when our labor capital is exhausted, and ultimately giving money to the people and causes dearest to us.

This commentary originally appeared March 21 on Forbes.com

By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them.

The opinions expressed by featured authors are their own and may not accurately reflect those of the BAM ALLIANCE. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice.