The Crucial Nature of Patience and Diversification

by Larry Swedroe

“Success in investing doesn’t correlate with IQ. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people in trouble investing.” — Warren Buffett

In my more than 20 years as the director of research for Buckingham Strategic Wealth and The BAM ALLIANCE, I’ve learned that, while financial economists understand that even 10 or 20 years of investment performance can be nothing more than “noise,” the vast majority of investors believe three years is a long time, five years is a really long time and 10 years is an eternity.

This is true even for institutional investors—who should know better—as evidenced by the fact that the typical horizon over which investment managers are judged is three years.

The lesson I’ve taken from this knowledge is that investment discipline—the ability to adhere to a well-thought-out strategy (asset allocation)—is likely to prove far more important for helping investors meet their goals than the specific asset allocation decision itself.

The reason is the well-documented tendency for individual investors to chase performance, buying what has done well recently (buying relatively high) and selling what has done poorly (selling relatively low)—not exactly a recipe for successful investing.

In addition, once investors remove assets from the equity markets, it’s difficult to get back in, because there’s never a green flag letting them know it’s once again safe to enter.

Odds of Negative Premiums

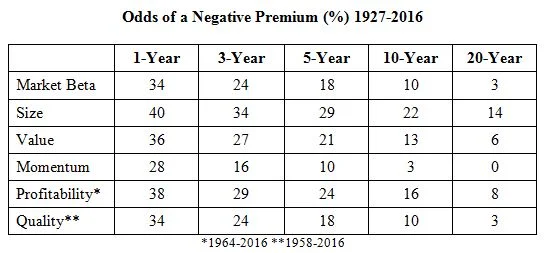

In our book, “Your Complete Guide to Factor-Based Investing,” my co-author Andrew Berkin and I present the following table, which provides the historical odds of underperformance for six factors that have provided equity premiums.

These premiums have been persistent over long periods of time and across economic regimes, pervasive around the globe (and even across asset classes), robust to various definitions, implementable (meaning they survive transaction costs), and have intuitive risk-based or behavioral explanations that afford confidence the premium will persist.

No matter how long the horizon, each of the individual factors have experienced some periods of negative performance, even at long horizons. Even the equity premium, market beta, was negative in 10% of 10-year periods and in 3% of 20-year periods. As you can see, the sole exception is momentum at 20 years. However, that, of course, doesn’t guarantee future success for momentum at 20-year horizons.

In my book, “Think, Act, and Invest Like Warren Buffett,” I note the great irony that, while investors idolize the “Oracle of Omaha,” they not only tend to ignore his advice, they then tend to do precisely the opposite of what he recommends.

For instance, we know that Buffett did not abandon his belief in value investing during the growth bubble of the late 1990s (when the value premium was highly negative). And we know he hasn’t abandoned it yet (despite the value premium now having been negative for more than 10 years). However, many investors will begin questioning the value premium’s existence after even just a few years of negative performance.

The evidence in the following table, which presents the historical premiums and standard deviations of the various equity premiums, offers important insights into why long horizons, and thus discipline, are the key to successful investing—and why Buffett has been so successful (his favorite time frame is forever). It shows that the volatility of each of the annual premiums has been a multiple (ranging from 1.7x to 4.1x) of the premiums themselves.

Implications of Volatility

In their November 2017 paper, “Volatility Lessons,” Eugene Fama and Kenneth French provide valuable insights for investors. Their study, which used bootstrap simulations (random sampling from the actual empirical distribution) to examine the volatility of three equity risk premiums (market beta, size and value), covered the period July 1963 through 2016. They found:

- The three equity premiums are statistically significant, large and highly volatile. The monthly market beta premium was 0.51% and its monthly standard deviation was 4.42%, 8.7 times larger than the premium itself; the monthly value premium was 0.29% and its monthly standard deviation was 2.19%, more than 7.6 times larger than the premium itself; the monthly size premium was 0.27% and its monthly standard deviation was 2.82%, 10.4 times larger than the premium itself. The high volatility creates great uncertainty as to future premiums, both in amount and persistence.

- As the return horizon increases, premium distributions become more disperse. The good news is that they move toward higher values faster than they become more disperse. For example, monthly equity premiums are leptokurtic, meaning there are more extreme returns than in a normal distribution. Kurtosis (a measure of how fat the tails are) is 3.0 for a normal distribution, but is 5.0 for the monthly equity premiums from 1963 through 2016. Kurtosis falls to 3.2 for annual premiums, but then rises strongly for longer return horizons, all the way to 32.4 for 30-year returns. The standard deviation of equity premiums increases with the return horizon, from 17% for annual premiums to 2,551% for 30-year premiums. Results are directionally similar for the size and value premiums.

- While the distribution of premiums moves toward higher values faster than its dispersion increases, rising dispersion pushes the extremely bad outcomes into even worse territory for longer horizons. At longer horizons, the cumulative effect of uncertainty about the expected premium becomes relatively more important.

- The value and small-cap stock premiums are always risky, but for longer return horizons, good outcomes become more likely and more extreme relative to bad outcomes.

These findings led Fama and French to conclude: “Even if future expected premiums match high past averages, high volatility means that for the three- and five-year periods commonly used to evaluate asset allocations, the probabilities of negative realized premiums are substantial, and the probabilities are nontrivial for even 10-year and 20-year periods.”

The authors continued: “Even if we assume future monthly returns are from the observed distribution of realized monthly returns that produced the large positive premium, so we are certain the expected premium is positive and large, the high volatility creates substantial uncertainty about whether future realized premiums will be positive even over relatively long periods.”

They added this warning: “Negative equity premiums and negative premiums of value and small stock returns relative to Market are commonplace for three- to five-year periods, and they are far from rare for ten-year periods. Given this uncertainty, investors who will abandon equities or tilts toward value or small stocks in the face of three, five, or even ten years of disappointing returns may be wise to avoid these strategies in the first place.”

The reason is that, for investors with the same three-year and five-year performance evaluation horizon periods often the focus of professional investors, negative equity premiums occur in 29% of three-year and 23% of five-year simulation runs. Even for 10- and 20-year periods, negative premiums occur in 16% and 8% of simulation runs.

As further examples of the uncertainty of premiums, the probability of a negative size premium over three- and five-year horizons has been 34% and 30%. For small value stocks, the probability has been 18% and 12%, respectively. The probabilities have been nontrivial even at 10 years—22% for small stocks and 5% for small value. The figures for a negative premium over 20 years were 14% for small stocks and just 1% for small value.

Summary

While the high volatility of stock returns is common knowledge, even many professional investors seem unaware of its implications, which is that substantial uncertainty surrounding the future realization of premiums exists.

Because of that, investors must be prepared to endure long periods of underperformance. Unfortunately, there simply are no clear crystal balls that allow investors to successfully time the various premiums.

Thus, the prudent strategy (the one most likely to allow you to achieve your goals) is to diversify across various factors, not concentrating risk in any single factor (which is typical of most “conventional” marketlike 60% equity/40% bond portfolios that have as much as 85-90% of their total risk in the market beta factor). Diversification reduces the risk of having too many of your eggs in the one basket that draws the short straw over your investment horizon.

This commentary originally appeared January 3 on ETF.com

By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them.

The opinions expressed by featured authors are their own and may not accurately reflect those of the BAM ALLIANCE. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice.